The importance of Watchdogs for Nonprofits

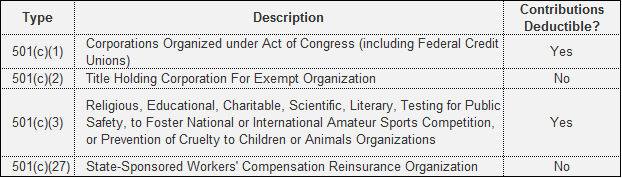

A non-profit organization is a group organized for purposes other than generating profit and in which no part of the organization’s income is distributed to its members, directors, or officers. The IRS defines 29 categories of organizations that are exempt from federal income taxes. The most known nonprofit is classified as a 501(c)(3), which includes public charities or private foundations. These categories are so crucial for both determining type of charity activates and whether donations to these organizations are tax-deductible for donors. (Those interested can cast an eye the IRS Publication 557)

Considering that approximately 1.6 million nonprofits are registered in the US, and that the nonprofits contribute more than one trillion dollars to the US economy, besides independent auditing, the importance of agencies known as watchdogs is also emerging. Here it is the watchdog who keeps an eye on a particular entity or a particular element of community concern, and warns members of the community when potential or actual problems arise.

There are several “watchdog agencies” on the internet to help donors make informed choices about the charitable organizations they want to support. Of some well-known charity watchdogs are Charity Navigator, Ministry Watch, GuideStar, and BBB Wise Giving Alliance, which will appear when individuals search for specific nonprofits online. Charity ratings are evaluations created by watchdog agencies who are also nonprofit entities. The points created by watchdog agencies will help charities to fund externally and will generate data for people/entities that want to donate in terms of reliability and transparency.

Watchdogs primarily pull evaluative information from the publicly available IRS Form 990 with additional information coming from the nonprofits website. This form is required to be filed by tax-exempt organizations who receive more than $50k a year in revenue. But, most small tax-exempt organizations with gross receipts that are normally $50k or less must file the IRS form 990-N, known as the “e-postcard” to satisfy their annual reporting requirement.

Pay attention to pages 3 through 6 consisting of “Yes”, “No” questions in Form 990 whether the charity is committed to best practices within the scope of evidence of the charity’s commitment to accountability and transparency. Besides that, while clarity and transparency are of utmost importance to the presentation of an organization’s 990, providing too much information which is not required by the IRS and that is not available in a public search “It may open up a not-for-profit to undue scrutiny”. Charity watchdogs’ evaluations are done on an annual basis. Secondly, in order to improve transparency and score, update/strengthen charity’s website by making available information to donor and third parties.

As related to making charities financially accountable, the BBB Wise Standards for Charity Accountability’s finance section outlines seven requirements.

- Spend at least 65% of its total expenses on program activities,

- Spend no more than 35% of related contributions — donations, legacies and other gifts received as a result of fundraising efforts — on fundraising,

- Avoid accumulating funds that could be used for current program activities — unrestricted net assets available for use should not be more than three times the size of the past year’s expenses or three times the size of the current year’s budget, whichever is higher,

- Make available to all, upon request, complete annual financial statements prepared in accordance with Generally Accepted Accounting Principles (GAAP), and, if total annual gross income exceeds $250,000, have these statements audited in accordance with GAAP,

- Include in the financial statements a breakdown of expenses (for example, salaries, travel and postage) that shows what portion of these expenses was allocated to program, fundraising and administrative activities,

- Accurately report its expenses, including any joint cost allocations, in its financial statements,

- Have a board-approved annual budget for its current fiscal year, outlining projected expenses for major program activities, fundraising and administration.