An overview of the Single Audit’s function, historical process, and practice

Each year, the federal government awards billions of dollars grants to state and local governments and nonprofit organizations for the public interest as a national commitment to key strategic objectives including healthcare, education, social services, and so on. It has come to a point where, as per numbers in the White House’s analytical Perspective, the Federal Government spent $829 billion in 2020, estimated to be $1 trillion in 2021 and the budget provides $1.1 trillion in 2022. It is obvious that it has been gaining an increasing momentum from the past to the present. That’s why, it appears an audit about whether the grants given are used at the right times to the right people and in right places.

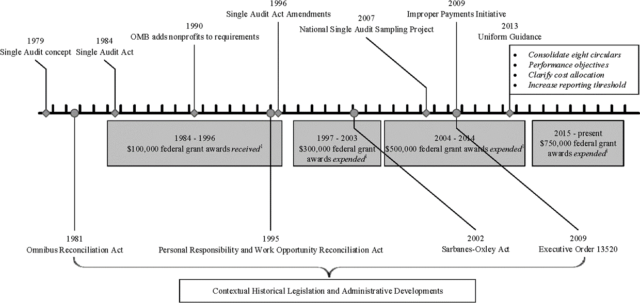

Before 1984, each federal grant-making agency was required to carry out its own audit based on grant-by-grant basis. However, each grant has its own unique requirements, such that, no two audits are exactly the same. That’s why, it was decided that a single audit can be completed for all recipients to be used by all Federal agencies and improve the effectiveness of audits of federal awards by reducing the audit burden on government agencies. Therefore, the formation, which existed as a concept in the 1970s, was enacted in 1984 as The Single Audit Act.

Journal of Governmental & Nonprofit Accounting. 2019;8(1):21-35. doi:10.2308/ogna-52470

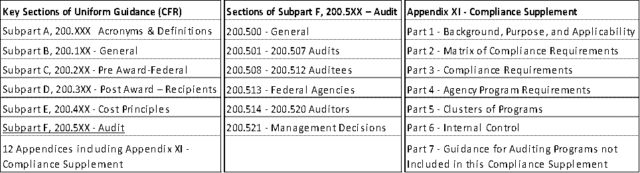

Requirements for single audits of nonprofit organizations were not clear in the 1984 Act. That’s why, in 1990, the OMB provided audit guidance to nonprofit organizations in Circular A-133 “Audits of Institutions of Higher Education and Other Non-Profit Organizations.” In 1996 OMB Circular A-133 was issued where the Single Audit Act Amendment was expanded to cover Institutions of higher education (IHE) and non-profit organizations received over a dollar threshold. With the issuance of the Uniform Guidance (2 CFR § 200.500 subpart F) in December 2013, the Single Audit Act provisions were rolled into the Uniform Guidance Audit Requirements. The Uniform Guidance applies to all new federal awards issued on or after December 26, 2014

Scope of Audit

A Single Audit is performed following three sets of professional auditing standard and requirements: GAAS issued by the AICPA, secondly GAGAS issued the U.S. Government Accountability Office (referred to as Yellow Book) and lastly Uniform Guidance (2 CFR Part 200).

- General; the audit must be conducted in accordance with GAGAS, also known as the Yellow Book.

- Organizations that follow GAGAS requirements undergo a peer-review from an outside audit agency roughly every three years. Peer-reviews can look at any audits released in the three years prior and ensure that prior audits were conducted according to GAGAS standards. The results of the peer-review are then made publicly available, such as being posted on the peer-reviewed agency website.

- Financial Statements; the auditor must determine whether the financial statements of the auditee are presented fairly in all material respects in accordance with GAAP. The auditor must also determine whether the Schedule of Expenditures of Federal Awards (SEFA) is stated fairly in all material respects in relation to the auditee’s financial statements as a whole.

- SEFA; the single audit reporting package includes the non-Federal entity’s Schedule of Expenditures of Federal Awards (SEFA). All expenditures of Federal funds must be accounted for in the annual SEFA whether funds are received directly from a Federal agency or indirectly from a pass-through entity. Completeness and accuracy of the SEFA is critical to avoid programs being missed.

- It also provides a picture of all federal awards for which an organization expended funds during its fiscal year. Auditors also use the SEFA to determine which programs listed are “major programs” or require testing in the compliance audit.

- Internal Control; as a condition of receiving federal awards, non-federal entities agree to comply with laws, regulations, and the provisions of grant agreements and contracts, and to also maintain internal control to provide reasonable assurance of compliance within these requirements in the scope of “Standards for Internal Control in the Federal Government (known as Green Book)” issued by the Government Accountability Office and “Internal Control Integrated Framework” issued by COSO.

- Compliance; auditor must determine whether the auditee has complied with Federal statutes, regulations, and the terms and conditions of Federal awards that may have a direct and material effect on each of its major programs.

- Audit follow-up; the auditor must follow-up on prior audit findings and gather required data elements of the data collection.

Process of Performing a Single Audit

Auditors perform the following major steps to complete a single audit ensuring the financial statements with SEFA present fairly and compliance with compliance requirement for each major federal program selected for review.

- Make a list of funds received (SEFA)

- It specifies in section § 200.510(b) that the auditee (management) must prepare a schedule of expenditures of Federal awards and specifies what it should include. Therefore, the auditee is responsible for the preparation of the SEFA. In addition, the auditor can assist in the preparation of the SEFA as a “non-audit” service, but all responsibility lies with the management.

- This schedule summarizes the grants received and how much was expended throughout the year. All grants/awards (even those that do not appear to be federally sourced) should be reviewed in detail to determine the funding source.

- Most federal awards are in the form of cash awards. However, there are a number of federal programs that do not involve cash transactions. Determination of that they have been expended and should be included in the SEFA.

- If the grant/award contains federal funding, the organization will obtain; name of the federal agency, award period, Catalog of Federal Domestic Assistance (CFDA) number.

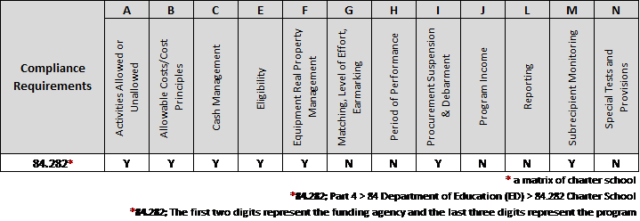

The Catalog of Federal Domestic Assistance (CFDA) provides a full listing of Federal programs, some of these CFDA numbers are required to be clustered on the SEFA. For example, a program with a CFDA number in Part 2-The Matrix of Compliance Requirements (within “the Compliance Supplement”); “N” and “Y” in a program matrix indicates whether or not a type of compliance requirement is subject to the audit. But, auditors have responsibility for all such as GAAS, GAS (yellow book), laws, regulations, contracts, and grant agreements, etc.

-

- The OMB ordered each federal agency to assign a FAIN that stands for Federal Award Identification Number, to all financial assistance awards for tracking purposes. The FAIN number specified for each program should be in SEFA. In addition, if the grant/award is passed through to/ from a sub-recipient, the pass-through entity identifying number.

- Besides SEFA, as related to the state grants, “Schedule of Expenditures of State Financial Assistance” must be added to the single audit report as Schedule-B (SEFA, Schedule-A).

- Criteria for a low-risk auditee in § 200.520; this title that it will be discussed will gain more meaning for us in the determination of the Major programs. An auditee that meets all of the following conditions for each of the preceding two audit periods must qualify as a low-risk auditee and be eligible for reduced audit coverage in accordance with § 200.518.

-

- Single Audits

- Unmodified opinion on the financial statements

- No deficiencies in internal control

- No substantial doubt with regards to a going concern

- No have audit findings in either of the preceding two audits classified as Type A

- Deficiencies in internal control

- Modified opinion on a major program

- Known or likely questioned costs* that exceeded %5 of the total Federal awards expended for a Type A

* Under Uniform Guidance, the known and likely questioned costs threshold has been raised from $10,000 to $25,000. If there are known and/or likely questioned costs that exceed $25,000, they must be reported as an audit finding

- Major program determination

As per description as in the § 200.518; the auditor must use a risk-based approach to determine which Federal programs are major programs. There are a few steps needed so as to determine which federal program will be tested. The auditor will utilize the information provided in the SEFA to identify the major program.

-

- Identify the larger federal programs and label them as type A or B.

- Type A programs are federal awards that expended $750,000 or more but less than $25 million in the year. Generally, Type A programs must be tested, but it can depend on the assessed risk. Type B programs are the rest of the federal awards that did not expend over $750,000.

- Some assessments in determining Type A program as low risk; in order to determine low risk Type A program, we are going to take advantage of the last clause in the Criteria for a low-risk auditee in § 200.520.

- Audited as a major program in at least one of the two most recent audit periods

- Must not have had a material weakness over internal controls

- Must not have had a modified opinion in the last audit

- Must not have had any questioned costs over 5% of total federal award

- High risk type B programs must be identified using professional judgement. This professional judgement has been described in § 200.519.

- Generally, auditor’s determination

- Current and prior audit experience

- Oversight exercised by Federal agencies and pass-through entities

- Inherent risk of the Federal program

- Identify the larger federal programs and label them as type A or B.

As a result, there is one last criterion for determining the major program(s) to test in § 200.518 as percentage of coverage rule; the federal award(s) selected needs to meet the minimum coverage requirement. An entity that is not a low risk auditee overall has a requirement for 40% of the total federal awards expended to be tested, and a low risk auditee’s requirement is for 20% coverage.

After going through these steps, the auditor will have determined which major program(s) to test as per single audit requirements.

** Not: A case study is included at the end of this article because determining a major program is so important.

Evaluating Major Programs for Compliance

In the wake of determining the major programs, Auditors will go through “the Compliance Supplement” for guidance. We actually talked a little bit about this report in the preparation of SEFA section, and went into the topic. This document guides auditors on the specific compliance requirements that are direct and material to each program listed and it provides the information needed by auditors to perform the single audits and is updated annually for new programs and changes to existing programs.

* An example of “a part of Compliance Supplement” can be found in the part of SEFA’s preparation under determining a CFDA number in Part 2-The Matrix of Compliance Requirements

After touching on a few issues very briefly, we are going to conclude the audit section.

- The grant/award should also be analyzed to determine if it is part of a cluster (including research and development) or a federal loan program as in described in Part 5- Clusters of Programs.

- The grant/award should also be categorized according to Fund Types; there are three groups of funds for which financial statements are prepared—governmental, proprietary, and fiduciary.

- Governmental Funds; General Fund, Special Revenue Fund, Debt Service Fund, Capital Project Fund and Permanent Funds

- Proprietary Funds; Enterprise Fund and Internal Service Funds

- Fiduciary Funds; Trust Funds as Pension, Investment, Private-Purpose and Agency Fund

- Communicating Compliance Deficiencies and Audit Opinions

- Keep in mind non-cash federal assistance programs, such as free rent, food stamps, food commodities, donated property, or donated surplus property and contributions provided by the State such as TPAF contributions.

- Always keep an ear in the industry you are audited to avoid missing anything; e.g. such as the Individuals with Disabilities Education Act (IDEA) for children getting special education services in a school audit.

- As CAFR report format; It may be used “Outline for Comprehensive Annual Financial Report” issued by New Jersey with date revised 7/09.

- The Single Audit must be completed and submitted in machine-readable format to the Federal Audit Clearinghouse (FAC) either 30 days after receiving the auditor’s report, or nine months after the end of the nonprofit’s fiscal year, whichever comes earlier.

OMB issued M-21-20, the extension provides for additional six months beyond the normal due date and applies to all recipients and subrecipients that have fiscal year-ends through June 30, 2021.

- The government provided numerous COVID relief packages. As a result of receiving these relief funds, many entities will need a Single Audit for the first time. It must be considered whether receiving and expending more than $750,000 in COVID relief such as Provider Relief Fund (PRF), Coronavirus Relief Fund (CRF), Education Stabilization Fund (ESF) and Loans under the Economic Injury Disaster Loan (EIDL) program. Note that SBA has confirmed that Paycheck Protection Program (PPP) loans are not subject to Single Audit.

State Law Nonprofit Audit Requirements (regular audit, not single audit)

Many states require charitable nonprofits to submit a copy of audited financial statements in conjunction with the process of registering the charitable nonprofit so that it is able to lawfully engage in fundraising activities in that state. As you know, state laws often differ from one another. Consequently, the laws that require a charitable nonprofit to submit audited financial statements also vary state-by-state.

For Instance;

- New Jersey

Audit Required: Yes

Statute and Description: New Jersey Administrative Code N.J.A.C. 13:48 A charitable organization with total annual revenue of $500,000 or above must submit an independent audit. For those with gross revenue between $25,000 and less than $500,000, the financial statements must be certified by the organization’s president or other authorized officer. For more information contact the New Jersey Center for Non-Profits.

Keep “the single audit” in a corner of your mind; if nonprofit receives any government funds–state or federal — it is always a good idea to determine whether there is an accompanying audit requirement. Various state and local laws may also require an independent financial audit for charitable nonprofits that receive funds from state and local governments.

According to the circular issued by the New Jersey Department of the Treasury on 12.06.2014;

- The Uniform Guidance raises the single audit expenditure threshold to $750.000. The new single audit expenditure threshold is applicable for recipients expending federal funds or State funds of $750.000 of greater during any fiscal year period beginning after December 26, 2014.

It is really difficult to express such a comprehensive subject in such a short article, but I hope it will at least give you an idea of what to look for when you say what “Single Audit” is.