Global Study on Occupational Fraud and Abuse

The Association of Certified Fraud Examiners (ACFE) created the Report to the Nations, which is a global study of occupational fraud and abuse. This report captures data on real fraud cases and explores the true cost, tactics, victims, and perpetrators of fraud schemes. The statistics in the report provide many great insights. The cases in the study occurred in 125 countries throughout the world, which also helps underscore the global nature of the threat posed by occupational fraud.

The Occupational Fraud

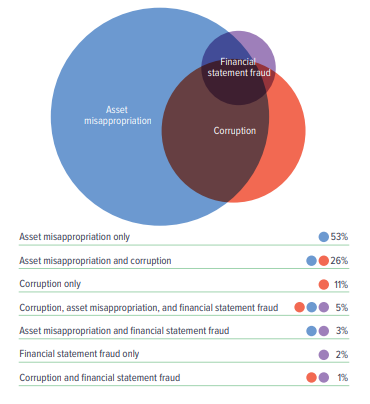

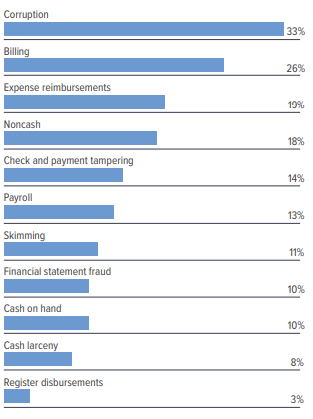

Categories of occupational fraud at the highest level, there are three primary categories of occupational fraud. Asset misappropriation, which involves an employee stealing or misusing the employing organization’s resources, occurs in the vast majority of fraud schemes (86% of cases); but, these schemes also tend to cause the lowest median loss.

In contrast, financial statement fraud schemes, in which the perpetrator intentionally causes a material misstatement or omission in the organization’s financial statements, are the least common (10% of schemes) but costliest category of occupational fraud. The third category, corruption—which includes offenses such as bribery, conflicts of interest, and extortion—falls in the middle in terms of both frequency and financial damage. These schemes occur in 43% of cases and cause a median loss.

How occupational fraud is concealed; Understanding the methods fraudsters use to conceal their crimes can assist organizations in more effectively detecting and preventing similar schemes in the future.

- Created fraudulent physical documents %40

- Altered physical documents %36

- Altered electronic documents or files %27

- Created fraudulent electronic documents or files %26

- No any attempts to conceal the fraud %12

Detection of Occupational Fraud

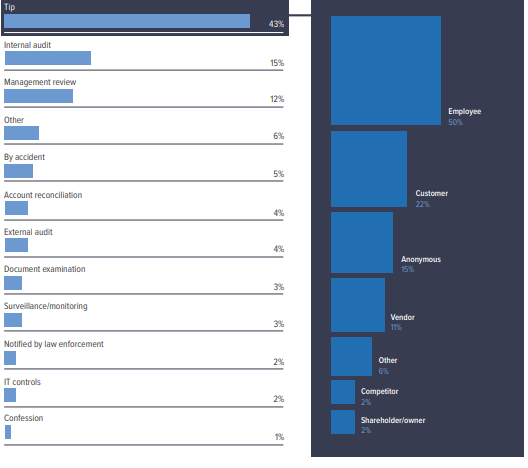

Detection is an important concept in fraud investigation because the speed with which fraud is detected as well as the way it is detected, can have a significant impact on the size of the fraud. It is also key to fraud prevention because organizations can take steps to improve how they detect fraud, which in turn increases the staff’s perception that fraud will be detected and might help deter future misconduct.

More than 40% of cases in study were uncovered by tips, which is almost three times as many cases as the next-most common detection method. Therefore, processes to cultivate and thoroughly evaluate tips should be a priority for fraud examiners. Reporting types;

- Telephone hotline %33

- Email %33

- Web-based/online form %32

- Mailed letter/form %12

- Other %13

Perpetrators

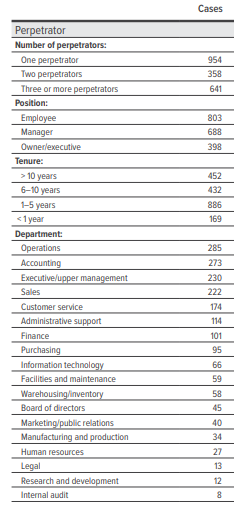

One of the key goals of the study is to identify the common characteristics and risk profiles of those who commit occupational fraud. The perpetrator’s level of authority within an organization tends to strongly correlate with the size of a fraud. There is an inverse relationship between the number of cases and the resulting loss.

Owners/executives accounted for only 20% of the frauds in the study, but the loss in those cases far exceeded the losses caused by managers and staff-level employees. Owners/executives are generally in a better position to override controls than their lower-level counterparts, and they often have greater access to an organization’s assets. Both of these facts might help explain why losses attributable to this group tend to be so much larger.

Owners/executives accounted for only 20% of the frauds in the study, but the loss in those cases far exceeded the losses caused by managers and staff-level employees. Owners/executives are generally in a better position to override controls than their lower-level counterparts, and they often have greater access to an organization’s assets. Both of these facts might help explain why losses attributable to this group tend to be so much larger.

Correlation between case and loss by departments;

Case & Loss Cases

- Board of Directors %2 %21

- Executive/upper mgmt. %12 %17

- Research and Dev. %1 %10

- Manufacturing and Prod. %2 %8

- Accounting %14 %5.5

- Purchasing %5 %5.5

- Information Technology %3 %5.5

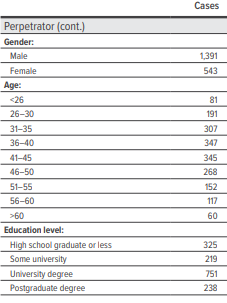

While 53% of fraudsters aged 31-45 cause a median loss, losses tend to increase with the age of the perpetrator. Those aged 56-60 and 60+ together accounted for less than 10% of all cases, but were the ones causing the highest losses in those age range.

Past studies have shown that most occupational fraudsters have no prior criminal history. Only 4% of the perpetrators in this study had been previously convicted of a fraud-related offense.

Behavioral Red Flags of Fraud

Recognizing the behavioral clues displayed by fraudsters can help organizations more effectively detect fraud and minimize their losses. % 85 of all fraudsters displayed at least one behavioral red flags while committing their crimes.

Seven key warning signs;

- Living beyond means %42

- Financial difficulties %26

- Unusually close association with vendor/customer %19

- Control issues, unwillingness to share duties %15

- Irritability, suspiciousness, or defensiveness %13

- “Wheeler-dealer” attitude %13

- Divorce/family problems %12

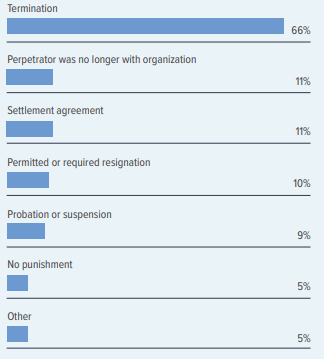

Case Results

Once an internal fraud is substantiated, the victim organization must decide what to do with the perpetrator. Termination was by far the most common response to fraud, but one-third of cases ended with a different internal result. Many cases resulted in relatively light punishments, where the perpetrator had already left the organization (11%), resigned (10%), or received no punishment at all (5%).

Recovering Fraud Losses

For many victim organizations, recovering losses is the key concern once fraud has been detected. However, most organizations (54%) in the study did not recover any of their losses. Recovering by the regions; Eastern Europe and Western/Central Asia was the most difficult region for recovering fraud losses, with 61% of organizations recovering nothing, followed closely by Latin America and the Caribbean (60%). Western Europe and Southern Asia were the only regions where more than half of victims made at least some recovery of fraud losses.

Reginal Focus: United States and Canada

Country # of cases

- Canada 66

- USA 829

Occupational fraud initially detection;

- Tips %37

- Management Review %15

- Internal Audit %15

- By accident %7

- Other %6

- Account Reconciliation %4

- Document Examination %4

- External Audit %4

- Surveillance/monitoring %3

- Notification by law enforcement %3

- Confession %1

- IT controls %1

Report to the Nations, “2020 Global Study on Occupational Fraud and Abuse”